So, What is a Property Investor in the UK?

Property Investment: The Basics

A property investor in the UK is someone who buys real estate, like houses, flats, or commercial buildings, to make money. Instead of living in these properties, they either rent them out to others or sell them at a higher price later. This type of investment is seen as a way to build wealth over time, often referred to as building a “property portfolio.”

What is Property Investment?

Think of property investment like planting a tree. You buy a property today, just like planting a seed. Over time, the value of the property can grow, just as the tree would. While you wait for it to grow, you can earn money by renting it out, which is like picking fruit from the tree every season. When the property’s value has increased enough, you can sell it for more than what you paid, much like cutting down a tree to use its wood. The key is patience and making sure you plant in the right soil, which in this case means buying in the right location.

Strategies for Property Investors

- Buy-to-Let: This is one of the most common strategies. You buy a property, rent it out to tenants, and use the rental income to cover your mortgage and other costs. Over time, as the property’s value increases, you can sell it for a profit or continue to enjoy a steady income stream. Learn more about buy-to-let properties in Liverpool in the North West, this area is seeing significant growth in the sector.

- Flipping: This strategy involves buying a property, renovating it, and then selling it quickly for a profit. It’s like buying an old car, fixing it up, and selling it at a higher price. This strategy requires a good eye for properties that can be improved and a solid understanding of renovation costs.

- Commercial Property Investment: Instead of residential properties, some investors focus on commercial buildings like offices, shops, or warehouses. These investments can offer higher returns but may also come with higher risks and require more capital.

- HMO (House in Multiple Occupation): This is where a property is rented out to several tenants who share common areas like the kitchen and bathroom. It can generate more rental income compared to a single tenancy, but it also requires more management.

Who Becomes a Property Investor?

Property investors come from all walks of life, but they often share some common traits:

- Long-Term Thinkers: They’re patient and understand that property investment is usually about long-term gains, not quick wins.

- Risk Managers: They know that while property can be profitable, it also comes with risks like market fluctuations or problem tenants. They plan for these risks.

- Financially Savvy: They have a good understanding of finances, including mortgages, interest rates, and the costs associated with buying, selling, and maintaining properties.

- Strategic Planners: They don’t just buy properties on a whim. They research the market, understand local demand, and choose locations with potential for growth.

Common Demographics of Property Investors

- Age: Many property investors start in their 30s or 40s, once they’ve built up some savings or equity in their own home. However, there’s a growing trend of younger investors in their 20s entering the market, often with the help of family or by pooling resources with friends.

- Income: Property investors typically have a stable income or access to capital. This could come from a well-paying job, a business, or savings.

- Background: Many property investors have a background in business, finance, or real estate, but it’s not a requirement. Anyone with a keen interest in property and a willingness to learn can become a successful investor.

What Do Property Investors Gain?

- Income: Regular rental income is a key benefit. This can supplement or even replace a salary over time.

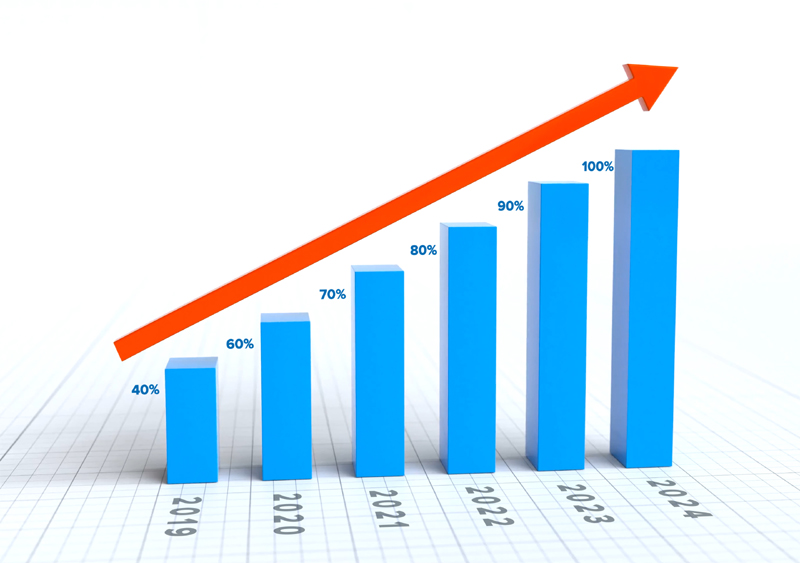

- Capital Growth: Over the years, as property values increase, the investor’s wealth grows. This is the “profit” when they eventually sell the property. Learn more about how to invest £100K in our handy guide.

- Control: Unlike other investments like stocks, property investors have more control over their investments. They can make decisions about renovations, tenants, and when to buy or sell.

- Stability: Property is often seen as a more stable investment compared to the stock market. Even though property prices can fluctuate, the demand for housing usually remains strong. Reading the latest UK House price statistics is highly recommended.

In essence, property investment in the UK is about building wealth by acquiring and managing real estate. It requires patience, strategy, and a good understanding of the market. Those who invest are often looking for long-term financial security and are willing to take calculated risks to achieve it

What Do Property Investors Do?

Property investors are individuals or companies who buy real estate with the primary goal of making a profit. Unlike someone who buys a home to live in, property investors treat real estate as a financial asset, much like stocks or bonds. Here’s a breakdown of what property investors typically do:

Research and Analyze the Market

Market Research: Property investors spend a significant amount of time researching different locations and market trends. They analyze factors such as property prices, rental yields, local amenities, transportation links, and future development plans. The goal is to find areas where property values are likely to rise, or where rental demand is strong. We recommend reviewing the How to get into property investment tutorial.

Property Analysis: Once they’ve identified a promising area, investors assess specific properties. They look at things like the property’s condition, the potential for renovation, and comparables (similar properties in the area) to estimate how much rent it could generate or how much it might sell for in the future.

Financing the Investment

Arranging Financing: Investors often use mortgages or other forms of finance to purchase properties. They might put down a deposit and borrow the rest from a bank or lender. The key is to secure a mortgage with terms that align with their investment strategy, whether it’s for a buy-to-let property or a property they plan to flip.

Budgeting: They create detailed budgets that include the purchase price, renovation costs (if needed), legal fees, mortgage payments, and any other expenses associated with owning the property.

Acquiring Properties

Purchasing: After securing financing, investors negotiate the purchase of properties. They aim to buy at a price that allows room for profit, either through rental income or by selling at a higher price later. We also recommend understanding where the best place to invest in property in the UK is.

Renovation and Development: Some investors focus on properties that need improvement. They oversee renovations, upgrades, or even complete redevelopments to increase the property’s value. This could involve anything from cosmetic updates to significant structural changes.

Managing the Property

Letting Out the Property: If the strategy is to rent out the property, investors either manage the rental process themselves or hire letting agents. This involves finding and vetting tenants, setting rental prices, and ensuring the property meets legal requirements.

Property Maintenance: Investors are responsible for the upkeep of their properties. This includes regular maintenance, repairs, and ensuring the property complies with health and safety standards.

Tenant Management: Managing tenants involves collecting rent, addressing tenant issues, and dealing with any disputes or problems that arise. Keeping good relations with tenants is key to ensuring a steady rental income.

Monitoring and Adjusting the Investment

Financial Monitoring: Investors regularly review their investment’s performance. They track rental income, property values, and expenses to ensure the investment is profitable. They may also refinance their mortgage or adjust rents to optimize returns.

Market Reassessment: Markets change, and savvy investors stay informed. They reassess their portfolio regularly, deciding whether to hold onto properties, sell, or buy new ones based on market conditions and personal financial goals.

Selling the Property

Exit Strategy: When the time is right, either because the property’s value has peaked or the investor’s goals have changed, they sell the property. This could be part of a planned exit strategy to realize capital gains or to reinvest in a new opportunity.

Profit Realization: The goal of selling is to realize a profit, either from the appreciation of the property’s value over time or from the income generated during the ownership period.

Portfolio Management

Diversification: Many property investors build a portfolio of properties. They might diversify across different types of real estate (residential, commercial, industrial) or in different geographical locations to spread risk.

Long-Term Planning: Investors often plan their property investments as part of a long-term strategy for financial security or retirement. This involves balancing short-term gains with long-term goals, such as paying off mortgages or achieving passive income streams. We recommend understanding more about some of the sales process rules, one example is learning what SSTC stands for.

Property investors engage in a range of activities from researching and acquiring properties, to managing and eventually selling them, all with the aim of generating profit. Their work requires a blend of market knowledge, financial acumen, and strategic planning. Whether they’re focused on rental income, capital appreciation, or a combination of both, property investors play an active role in managing and growing their investments.

How Can I Become a Property Investor?

Becoming a property investor is an exciting and potentially rewarding venture, but it requires careful planning, research, and a strategic approach. Here’s a step-by-step guide on how you can get started.

Educate Yourself

Learn the Basics, start by understanding the fundamentals of property investment. This includes learning about different types of properties (residential, commercial, buy-to-let, etc.), the property market, and the financial aspects such as mortgages, interest rates, and taxes. Read books and guides such as the RCCIL property investment guide, there are many books and online resources dedicated to property investment. These can provide valuable insights and tips from experienced investors. Attend seminars and workshops, Property investment seminars, workshops, and webinars are great places to learn from professionals and network with other aspiring investors. The Oxford University property investors course is a highly recommended option to consider.

Set Clear Goals

Define Your Objectives, and determine what you want to achieve with property investment. Are you looking for long-term capital growth, regular rental income, or perhaps a mix of both? Your goals will shape your investment strategy. Timeframe, decide on your investment horizon. Are you looking for quick returns through property flipping, or are you planning to build a portfolio over many years?

Assess Your Financial Situation

Review Your Finances, take a close look at your current financial situation. How much can you afford to invest? Do you have savings, or will you need financing?

Understand Your Credit: Check your credit score, as this will impact your ability to secure a mortgage. If your score needs improvement, work on it before applying for financing.

Budgeting: Create a budget that includes not just the purchase price of a property but also other costs like renovations, maintenance, legal fees, and taxes.

Create an Investment Strategy

Buy-to-Let: If you’re interested in earning rental income, focus on buy-to-let properties. Calculate potential rental yields and consider the costs of managing tenants.

Flipping: If you prefer to buy, renovate, and sell properties for a profit, focus on finding undervalued properties that can be improved.

Diversification: Consider diversifying your investments by owning different types of properties in various locations to spread risk.

Secure Financing

Mortgage Options: Research different mortgage options, including buy-to-let mortgages, which are specifically designed for property investors. Shop around for the best interest rates and terms.

Leverage: Understand how to use leverage (borrowing money) to maximize your investment potential, but be cautious of over-leveraging, which can increase your financial risk.

Build Your Team

Find Professionals: Build a network of professionals who can support you, including real estate agents, mortgage brokers, solicitors, accountants, and property managers. They can provide valuable advice and help you navigate the complexities of property investment.

Mentorship: If possible, find a mentor who is an experienced property investor. They can offer guidance and help you avoid common pitfalls.

Manage Your Investment

Property Management: If you choose to rent out your property, decide whether you want to manage it yourself or hire a property management company. Managing it yourself can save money but requires more time and effort.

Ongoing Maintenance: Keep your property in good condition to maintain its value and ensure it’s attractive to tenants or buyers.

Review and Expand

Monitor Your Investment: Regularly review the performance of your investment. Are you meeting your financial goals? Adjust your strategy if necessary.

Scale Up: Once you’ve successfully managed your first investment, consider expanding your portfolio. Use the equity from your first property to invest in additional properties.

Stay Informed

Market Trends: Keep up with the latest trends in the property market. This includes changes in property prices, rental demand, and government regulations.

Continuous Learning: Continue educating yourself as the market evolves. Attend seminars, read up on new strategies, and network with other investors.

Have an Exit Strategy

Plan Your Exit: Whether you intend to sell your property after a certain period, pass it down to your family, or use it to fund your retirement, it’s important to have a clear exit strategy in mind. This will help guide your decisions throughout your investment journey. Understanding the property investment risks is an important factor to consider understanding.

By following these steps, you can start your journey as a property investor with a solid foundation. Remember that property investment is a long-term commitment, requiring patience, diligence, and ongoing learning. With the right approach, it can be a highly rewarding way to build wealth and secure your financial future.